NSA Series: Part 3 of 9

April 13, 2022

What’s in a Section? Key Provisions of the No Surprises Act

The No Surprises Act impacts health plans, physicians, facilities and other non-MD/DO licensed healthcare professionals. It includes several sections outlining sweeping changes—including calls for price transparency, Provider directories and patient financial protections. In this third installment of our No Surprise Act (NSA) blog series, we’ll explore four sections that will greatly affect data exchange between Payers, Providers and patients. (Read the overview of the NSA and what it means for Payers and Providers.)

In this article, we’ll explore:

- Section 111: Advanced Explanation of Benefits (AEOB)

- Section 112: Good Faith Estimate (GFE)

- Section 114: Cost Comparison Tool

- Section 116: Provider Directory

Sections of the No Surprises Act

Section 102: Health insurance requirements regarding surprise medical billing

Section 103: Determination of out-of-network rates to be paid by health plans; Independent dispute resolution process

Section 104: Healthcare Provider requirements regarding surprise medical billing

Section 105: Ending of surprise air ambulance bills

Section 106: Reporting requirements regarding air ambulance services

Section 107: Transparency regarding in-network and out-of-network deductibles and out-of-pocket limitations

Section 108: Implementing protections against Provider discrimination

Section 109: Reports

Section 110: Consumer protections through application of health plan external review in cases of certain surprise medical bills

Section 111: Consumer protections through health plan requirements for fair and honest advance cost estimate

Section 112: Patient protections through transparency patient-provider dispute resolution

Section 113: Ensuring continuity of care

Section 114: Maintenance of cost comparison tool

Section 115: State All Payer Claims Databases

Section 116: Protecting patients and improving the accuracy of Provider directory information

Section 117: Advisory committee on ground ambulance and patient billing

Section 118: Implementation funding

Section 111: Advanced Explanation of Benefits (EOB)

The Advanced Explanation of Benefits (AEOB) lays out what portion of services will be covered by the health plan and what portion must be paid out-of-pocket by the patient. It offers consumer protections through fair and honest advance cost estimates through health plan requirements.

Effective date: Originally January 1, 2022—delayed enforcement

Applies to: All group health plans

How It Works

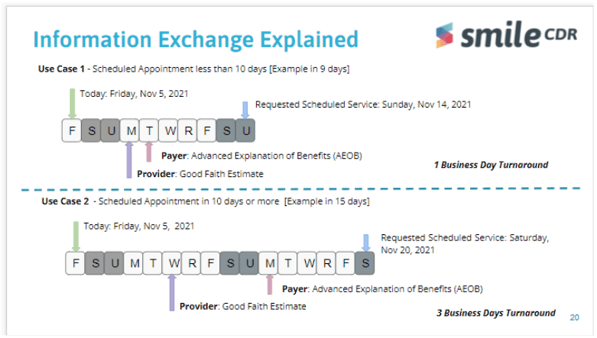

When a Provider sends a Good Faith Estimate (GFE) to the health plan (as required in Section 112 and discussed below), it triggers the need for an AEOB. The health plan must provide the Advanced EOB to patients before scheduled care or upon patient request before scheduling. It must be provided electronically or via mail (as requested by the participant), no later than one business day if the service is scheduled within 10days. If the service is scheduled in more than 10days, health plans must provide it within three business days.

The AEOB notice must include:

- The Provider or facility’s network status (in-network or out-of-network)

- If participating: The Provider’s contracted rate under the plan or coverage of the item or service based on the billing and diagnostic codes sent by the Provider.

- If non-participating: A description of how to obtain information on participating Providers must be included.

- The GFE sent by the Provider or facility, including likely billing and diagnostic codes

- The amount that the plan is responsible for paying and the amount of any cost-sharing for which the participant, beneficiary or enrollee is responsible to pay. (This is based on the notification date and not the date of service.)

- The amount that the participant, beneficiary or enrollee has incurred toward meeting the financial responsibility limit under the plan or coverage. (Includes deductibles and out-of-pocket maximums and is based on the date of the notification.)

- A disclaimer stating that the coverage for items or services is subject to a medical management technique if appropriate; the estimate is based on items and services reasonably expected when scheduling or requesting the service and is subject to change; and any other information the health plans deem appropriate for this notice.

Section 112: Good Faith Estimate (GFE)

The Good Faith Estimate (GFE) provides plans or insurers (or if uninsured, the individual) with a well-educated cost approximation in clear and understandable language. The healthcare Provider or facility must provide it promptly.

Effective date: Originally January 1, 2022. Enforcement delayed until future rulemaking.

Applies to: All healthcare Providers and facilities.

How It Works

Section 112 establishes a new requirement for both individual practitioners and facilities by asking them to provide estimates of the total expected charges for scheduled items or services. The goal is patient protection through transparency regarding patient-provider dispute resolution.

GFEs must include:

- Any item or services reasonably expected to be provided in conjunction with the scheduled item or service

- Any items or services expected to be provided by another Provider (e.g., anesthesia)

- The expected billing and diagnostic codes for all items and services

Providers must provide GFEs when items or services are scheduled or when requested by a patient. If the service is within 10 business days, Providers or facilities must provide a GFE no later than one business day after scheduling. If the service is scheduled for more than 10 business days in advance or the patient requests it, a GFE must be provided within three business days.

Section 114: Cost Comparison Tool

Health plans must offer a cost comparison tool that allows enrollees to compare expected out-of-pocket costs for items and services across multiple Providers, both online and over the telephone.

Effective date: Plan years beginning on or after January 1, 2023

Applies to: Group health plans and health insurers

How It Works

Section 114 of the Act requires health plans to maintain and offer a price comparison tool, resulting in greater billing transparency. This tool allows enrollees to compare the amount of cost sharing for a specific item or service by any participating Provider.

It should be noted that the CMS Transparency in Coverage rule also mandates that all group health plans build and maintain a cost-comparison tool both online and in print. Due to the duplicative nature of the two rules, HHS (in their August FAQ) suggested that the two cost comparison tools may be amalgamated. Therefore, all Payers would be responsible for creating and maintaining a cost comparison tool that allows enrollees to compare costs in print, over the telephone and online by January 1, 2023.

These price comparisons will need to be offered for plan years beginning on or after January 1, 2022. The price comparison tool will allow enrollees to compare cost-sharing by:

- Plan year

- Geographic region

- Participating Providers for the plan or coverage.

Section 116: Provider Directory (Section 2799B-9)

Plans must maintain an accurate Provider directory and update it regularly. If a patient relies upon information that is out-of-date and seeks services from an out-of-network Provider, then the plan is responsible for covering the difference in cost.

Effective date: January 1, 2022

Applies to: All healthcare Providers and facilities

How It Works

Section 116 protects patients from making expensive decisions based on inaccurate information. Health plans are required to establish:

- A publicly accessible Provider database

- A verification process to ensure accurate Provider directories

- A response protocol for individuals inquiring about the network status of a provider.

Updating the Provider directory is time-sensitive and health plans must:

- Update the Provider directory at least once every 90 days

- Update the Provider directory within two days of receiving a notice of change

- Respond to enrollees regarding a Provider’s network status within one business day of a request.

- Retain inquiry records for two years.

Additionally, health plans must offer a website directory that includes contracted Providers and relevant information such as Provider and facility contact information, specialty information, direct or indirect contractual relationship with the plan and digital contact information.

Failure to meet these requirements could come with a hefty price tag for health plans. If an enrollee provides documentation that he or she received and relied on incorrect information from the health plan regarding a Provider’s network status, then the enrollee will only be responsible for the in-network cost-sharing amount. This amount must count toward the patient’s in-network out-of-pocket maximum and in-network deductible.

Finally, Payers must offer information and other plan communications regarding balance billing protection— including the amount Providers or facilities may charge (if provided under state law) and the appropriate federal and state agency contacts to report violations— on their websites. Where state law applies, plans are also required to provide information about allowable charges by non-contracting Providers or facilities and any consumer cost-sharing obligations.

What Providers Need to Know

Providers are required to submit regular updates to group health plans and insurers to assist with their verification and update processes. Providers should submit Provider directory information:

- When the Provider or facility begins a network agreement with a plan or with an issuer concerning certain coverage,

- When the Provider or facility terminates a network agreement with a health plan or issuer for certain coverage,

- When there are material changes to the content of Provider directory information of the Provider or facility described.

The Act protects patients from surprise medical bills tied to out-of-network care in both emergency and non-emergency settings. To do so, it has many new requirements, including the GFE, AEOB and the ongoing maintenance of cost comparison tools and Provider directories. It also sets out tight turnaround times for providing information in a timely manner. Meeting these requirements and timelines may prove to be a challenge before Providers and health plans. However, FHIR solutions may be the key to supporting Providers and Payers to be compliant with the provisions under the No Surprises Act. But there’s a solution: efficient healthcare data exchange powered by HL7® FHIR®standards.

Check out the rest of the No Surprises Act blog series to learn how implementing the HL7® FHIR® standard is the solution for everyone involved:

Part 1: Implications of NSA

Part 2: NSA Glossary of Terms

Part 3: Understanding Key Provisions

Part 4: An Honest Assessment for Providers of NSA Implementation

Follow us on social:

-1.jpg)

The Urgent Need for HL7® FHIR® Adoption

Healthcare depends on the timely sharing of information...

Read More >>